Everyone will have to retire someday, be it 100% not working or being semi retired, we all will reach that stage one day. However not many have thought about what is needed or how they would like their retirement days to be. Something that I find strange or maybe its way too far away for us to comprehend?

So to make things slightly simple, if you are one who is curious about how much you will get if you save a monthly fixed amount for X amount of years.

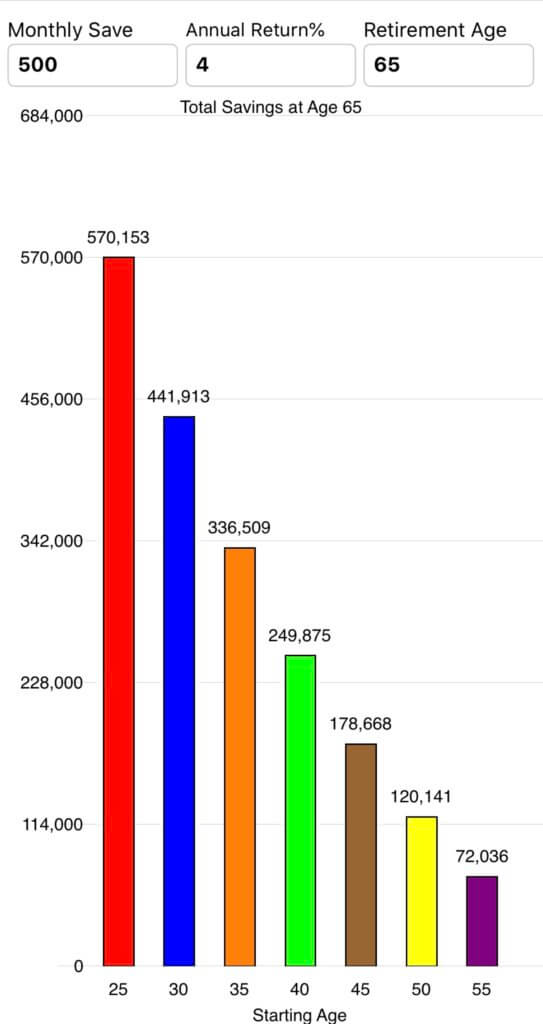

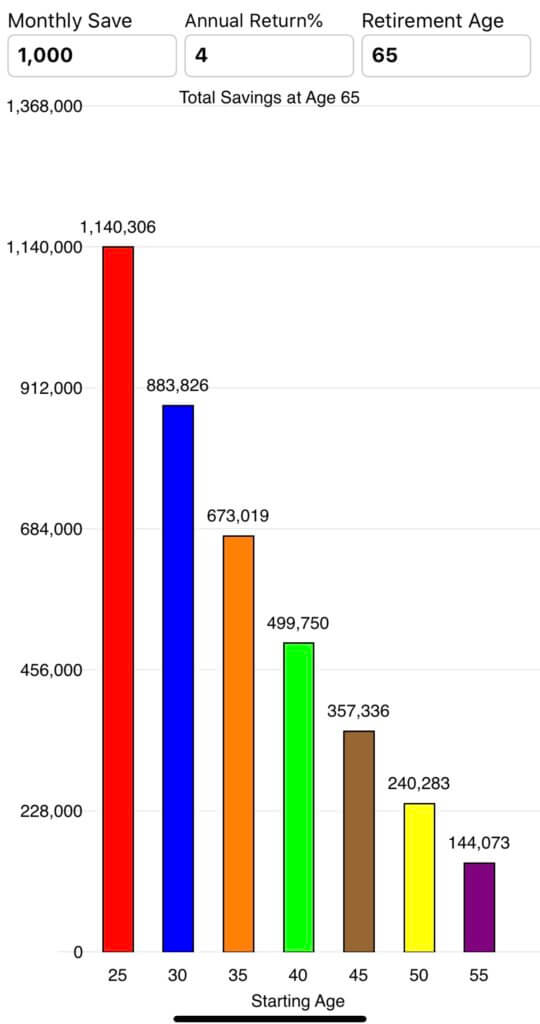

The following charts will be of interest to you. Using a calculator to draw up some scenarios for myself and friends to see how much we will have when we hit the age of 65 (retirement age) with compounding interest of 4%. Conventional wisdom or financial advisers will say 6-7% but I prefer to be on the prudent side. To get 4% every year for 25, 30 or 40 years seems alot doable than 6-7%. (Please feel free to challenge me :))

Start Early and Save Regularly Plan

Scenario 1 – Saving $100 a month from age 25 till 65 @ 4% annual return. Will give you $114,000. Not a lot to retire but better than nothing. So what’s important is to increase your savings rate and find investment vehicles that give you better returns.

Notice the later you start the amount is lesser.

Scenario 2 – Just having an average monthly saving of $500 a month drives up your returns by 400,000+.

Now if you start from 25 years old, you are a lot closer to a millionaire. If you ate at 35, 40, 45, 50 and 55, it’s not end of the world, we just need to save more and find better returning vehicles.

Scenario 3 – ramping up savings rate to 1k averagely.

if we start saving a $1000 a month from 25 yrs old to the age of 65, we would have gotten 1.1 million dollars in retirement funds. It’s doable if we start young and maintain focus.

What if I don’t make so much money…

I understand that some of us might not earn a big enough pay cheque to allow $1k savings per month. Do note that all these doesn’t have to be all cash. It’s just an indicator for you to see what is possible when it comes to retirement planning and investment. We can always use a combination of our cpf funds and cash funds to achieve this.

The key is to start first, even if it’s small, the power of compounding interest is huge… let’s not wait anymore.

Featured Images Source: Pixabay